Decoding Longevity: How AI is Ranking the Top Pharma Players

Have you ever wondered which pharmaceutical companies have extended human longevity in the past—and which ones will shape its future?

While the longevity biotechnology sector experiences another surge of interest, with startups like Altos Labs securing multi-billion dollar funding, significant investment and research are concurrently taking place within major pharmaceutical companies. For external observers, however, these longevity initiatives are often overshadowed by their traditional drug businesses, making it challenging to discern their specific contributions and overall impact on the field.

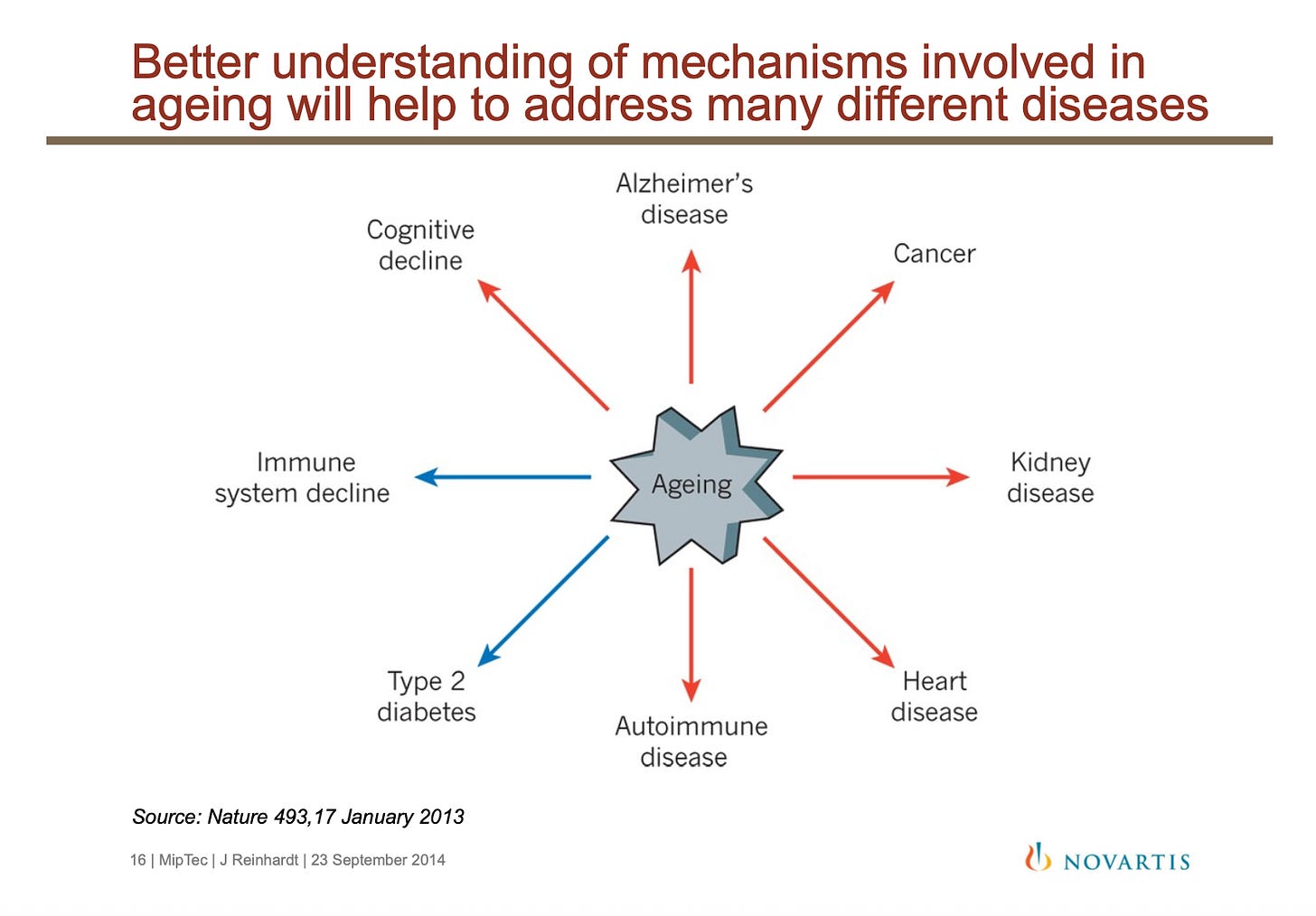

As someone with nearly 22 years in longevity biotechnology and a close involvement in aging research through the Aging Research and Drug Discovery (ARDD), the largest annual industry forum, I can readily identify the top two players. Eli Lilly undoubtedly holds the leading position, closely followed by Novo Nordisk. Eli Lilly has explicitly integrated longevity into its corporate strategy, a commitment announced by its R&D champion, Dr. Andrew Adams, at the 11th ARDD (his talk is available here), which subsequently encouraged other companies to pursue similar paths. Novartis likely ranks third, boasting approximately 100 scientists within its Diseases of Aging and Regenerative Medicine Group (DARe), led by Michaela Kneissel, who joined Novartis in 1996. Despite Novartis's long-standing focus on aging—I recall its former chairman Joerg Reinhardt presenting on RAD001 in aging at the first ARDD in 2014—their efforts haven't, to my knowledge, yielded any significant longevity drugs, but that's a topic for another discussion.

Chairman of Novartis presented a bold vision for using aging research as a platform for drug discovery in 2014 at MipTec in Basel. The ARDD was originally part of MipTec.

We need clear criteria for the evaluation and ranking of pharma companies in longevity and their total current and expected impact on human longevity. Without doubt, the #1 criteria for the ranking would be the current and upcoming products that significantly extend quality life for the largest number of people. I like to call this metric maxQALY - the total maximum number of Quality-Adjusted Life Years (QALY) the product is expected to generate during the person’s life multiplied by the number of people using the product. Secondary criteria would include internal R&D using aging as a platform for drug discovery, measuring aging biomarkers in clinical trials, publications in aging research, partnerships with longevity startups and academics, sponsorships of aging research events, the number of speakers and delegates at the ARDD, among many others.

One of the best ways to produce the unbiased report on who is who in longevity among the pharma companies is to use one or more of the frontier LLMs with deep research capabilities. Frontier LLMs may not be perfect for very specific questions but they are very good at summarizing trends. I usually ask every new frontier model “What are the top 3 AI drug discovery companies in the world today?” and if it shows Insilico Medicine at the top and shows the relevant competitors below it, I know I can trust it to some extent. Gemini 2.5Pro and ChatGPT o3Pro, and Grok4 successfully passed the “Insilico Medicine Test” and we will use them to evaluate the top pharma companies in longevity.

I asked each of these models to rank the top pharmaceutical companies by their impact on longevity in the past, in the present and in the future.

If you don’t want to read further, here is a summary. The LLM consensus is that Merck and Pfizer were the leaders of the past, Merck and BMS are leaders today, and Eli Lilly, and Novo Nordisk will make the biggest impact on longevity in the future.

In my opinion, Grok 4 produced the list that is most aligned with my personal ranking as it ranked Eli Lilly, Novo Nordisk, and Novartis as leaders and provided good historical overview very consistent with my personal views.

Eli Lilly emerged as the top-ranked firm in this forward-looking paradigm, a conclusion driven by its dual dominance in metabolic disease and its decisive investments in potentially curative technologies. On a side note, Eli Lilly will have the most number of scientists at the ARDD this year.

To generate an unbiased report on the leading pharmaceutical companies in longevity, we will leverage one or more frontier LLMs with advanced research capabilities. Frontier LLMs are still struggling with domain-specific tasks but they are amazing at integrating and summarizing the general knowledge about the companies and providing industry reports. Whenever a new model comes out, I usually test it with “What are the top 5 companies in AI drug discovery globally? Provide ranking, description, and AI productivity benchmarks”, if it fails to explain why Insilico Medicine is at the top, I do not use it for other reports. In my experience, Gemini 2.5Pro and ChatGPT 3oPro perform better at these tasks.

For this report, I utilized three frontier LLMs known for their deep research or reasoning abilities: Gemini 2.5 Pro, ChatGPT o3Pro, and Grok 4. I then summarized their outputs to achieve a consensus.

In summary, the LLM consensus indicates that Merck and Pfizer were historical leaders, Merck and BMS are current leaders, and Eli Lilly and Novo Nordisk are projected to have the most significant future impact on longevity.

In my opinion, Grok 4’s list most closely aligns with my personal ranking, as it positioned Eli Lilly, Novo Nordisk, and Novartis as leaders and offered a comprehensive historical overview.

Eli Lilly emerged as the top-ranked firm in this forward-looking paradigm. This conclusion is driven by its dual leadership in metabolic disease and its strategic investments in potentially curative technologies. Notably, Eli Lilly will have the highest number of scientists present at the ARDD this year.

Comparison of Overall Company Rankings by LLM

The selection of three different companies for the top rank is the most telling discrepancy. It reveals the core logic underpinning each model's evaluation:

ChatGPT as the "Historicist": ChatGPT's selection of Merck & Co. for the #1 position is rooted in a conservative, evidence-based evaluation that gives significant weight to cumulative, realized impact. Its analysis emphasizes Merck's unparalleled historical contributions through the development of the first statins and foundational vaccines, which saved millions of lives, combined with its revolutionary recent impact in immuno-oncology with Keytruda. This approach prioritizes a long and proven track record of delivering massive, population-wide Quality-Adjusted Life Year (QALY) gains.

Grok as the "Momentum Analyst": Grok's choice of Novo Nordisk as the #1 company reflects an analytical model heavily influenced by current market dynamics and near-term future potential. Novo Nordisk received 'A' ratings in Recent Impact, Future Potential, and Corporate Strategy, driven almost entirely by the monumental success and projected growth of its GLP-1 agonist franchise (Ozempic, Wegovy). The model's staggering 100 million QALY estimate for Novo's recent impact—the highest in its report—signals that its algorithm is heavily weighted towards the momentum of this single, transformative drug class.

Gemini as the "Futurist": Gemini's selection of Eli Lilly is the direct result of its transparent and forward-looking weighted scoring system. The model explicitly allocates 40% of the final score to "Future Potential" and 35% to "Recent Impact," with only 15% for historical contributions. Eli Lilly's 'A' ratings in these two high-weight categories, propelled by its own dominant GLP-1 pipeline (Mounjaro, Zepbound), its advanced Alzheimer's program, and its game-changing investment in curative gene-editing platforms, secure its top rank. This venture capital-style assessment prioritizes future disruptive potential over past performance.

This fundamental disagreement on the top-ranked company is a critical finding for any user of LLM-generated analysis. It demonstrates that the outputs are not objective truths but are shaped by the inherent, and often opaque, weighting and logic of the underlying model. Understanding these "personas" is essential for correctly interpreting their strategic recommendations.

Comparative Analysis of Historical Impact Ratings (Pre-2010)

The pre-2010 era is defined by foundational, mass-market medicines that addressed the 20th century's leading causes of premature death, primarily infectious and cardiovascular diseases. The models largely agree on the key companies and drug classes from this period but exhibit a dramatic divergence in their quantitative estimates of impact.

Leaders of the Past: Historical Impact Ratings and QALY Estimates (Pre-2010)

Note: QALYs (M) refers to estimated cumulative Quality-Adjusted Life Years generated, in millions. Gemini did not provide numerical QALY estimates.

The most significant finding in this category is the gross discrepancy in the QALY estimations between Grok and ChatGPT. Grok's estimates are consistently two to three times higher than ChatGPT's. For example, Grok attributes 150 million QALYs to Pfizer, whereas ChatGPT provides a more conservative range of 40-50 million. Similarly, Grok assigns Merck 120 million QALYs, compared to ChatGPT's 50-60 million.

This variance is not random but appears to stem from different methodological approaches to estimation:

Grok's Top-Down Market Model: Grok's rationale for Pfizer's 150 million QALYs is based on applying the market share of its blockbuster drug Lipitor (~40%) to a massive global patient population (~100 million) and multiplying by a high per-patient QALY gain (0.5-1.5). This suggests a simplified, top-down calculation driven by market penetration, which can lead to inflated, headline-grabbing figures that may not account for confounding factors or the impact of competing drugs.

ChatGPT's Bottom-Up Composite Model: In contrast, ChatGPT's estimate for Pfizer is built from the ground up. Its report provides a multi-factorial justification, breaking down the impact of Lipitor, but also accounting for contributions from the antihypertensive Norvasc, the company's role in mass-producing penicillin, and the acquisition of the Prevnar vaccine franchise from Wyeth. It frequently grounds its per-patient QALY gains in specific health economic studies, resulting in a more nuanced and conservative final estimate.

This methodological difference is crucial. It highlights that quantitative data from LLMs, especially complex metrics like QALYs, should not be taken at face value. Without transparent, verifiable methodologies, such figures are best treated as directional indicators of magnitude rather than precise calculations. Despite the quantitative differences, there is a strong consensus on the qualitative leaders. All three models award their highest historical ratings to Merck and Pfizer, recognizing their twin pillars of impact: pioneering statins for cardiovascular disease and leading the charge against infectious diseases through vaccines and antibiotics, respectively.

Comparative Analysis of Recent Impact Ratings (2010-2025)

The period from 2010 to 2025 was characterized by a revolution in biotechnology, leading to high-potency specialty drugs and a new class of mass-market blockbusters for metabolic disease. The models show universal agreement on the key technological drivers of this era, even as they differ on the precise ranking of the companies commercializing them.

Recent Leaders: Recent Impact Ratings and QALY Estimates (2010-2025) (Top 5)

Note: QALYs (M) refers to estimated cumulative Quality-Adjusted Life Years generated, in millions. Gemini did not provide numerical QALY estimates.

Across all three reports, two therapeutic areas are consistently identified as the primary drivers of longevity impact in the modern era:

Immuno-Oncology (I-O): The development of immune checkpoint inhibitors is hailed as a transformative advance. Merck's Keytruda (pembrolizumab) and Bristol Myers Squibb's Opdivo (nivolumab) and Yervoy (ipilimumab) are universally recognized for turning numerous late-stage cancers from terminal diagnoses into manageable, long-term conditions. The models concur that the substantial per-patient QALY gains from these therapies, which can add years of high-quality life, represent a monumental contribution to modern healthspan.

GLP-1 Agonists: The rise of this drug class for treating Type 2 diabetes and obesity is identified as a development with population-level impact rivaling historical breakthroughs. Novo Nordisk (Ozempic, Wegovy) and Eli Lilly (Trulicity, Mounjaro, Zepbound) are unanimously credited as the leaders of this revolution. The models agree that by addressing the foundational metabolic drivers of numerous age-related diseases—including cardiovascular disease, kidney disease, and certain cancers—these drugs are generating enormous QALY gains across a massive patient population.

The strong consensus on these two drug classes as the defining innovations of the 2010-2025 period is a significant finding. The differences in how the models rank the companies involved stem from the implicit weight each assigns to the two different impact models: the high per-patient gain in a smaller cancer population (I-O) versus the moderate per-patient gain in a vast metabolic disease population (GLP-1s). Grok and Gemini, with their focus on momentum and future potential, rank the GLP-1 companies (Novo Nordisk and Eli Lilly) higher, while ChatGPT's more historical perspective gives a slight edge to the I-O pioneers (Merck and BMS).

Future Leaders: Comparative Analysis of Future Potential Ratings (2025-2040)

The analysis of future potential, which evaluates R&D pipelines, is inherently speculative. However, the models demonstrate a remarkable convergence in their vision of what will drive the next wave of longevity impact. They collectively identify a clear set of therapeutic platforms and disease areas that will separate future leaders from the rest of the pack.

Future Pipeline Potential Ratings (2025-2040) (Top 5)

Note: Letter grades are provided by Gemini; qualitative ratings are from ChatGPT and Grok.

The models' analyses coalesce around three key platforms that are expected to define the future of longevity therapeutics:

Metabolic Disease and Neuroscience: There is unanimous agreement that the companies best positioned to tackle the twin epidemics of obesity and Alzheimer's disease will be the dominant players of the next decade. Eli Lilly and Novo Nordisk receive top marks from all three models for their formidable, late-stage pipelines in both areas. Their development of next-generation oral and combination GLP-1 therapies and their high-profile Alzheimer's drug candidates (like Lilly's donanemab) are seen as having the potential for massive, population-wide healthspan extension.

Geroscience and Foundational Aging Biology: The models reward companies that are moving beyond treating individual diseases to targeting the underlying biological mechanisms of aging itself. This represents a higher-risk, higher-reward strategy. AbbVie, through its multi-billion-dollar partnership with Google's Calico, and Novartis, through its network of collaborations with longevity biotechs like BioAge and Cambrian BioPharma, are consistently highlighted for their explicit investment in geroscience. These initiatives, which explore pathways like cellular senescence and mTOR, are viewed as bets on an entirely new model of healthcare.

Curative Platforms (Gene Editing): The Gemini report, in particular, identifies a third, highly disruptive platform: the use of "one-and-done" curative therapies. It singles out Eli Lilly's acquisition of Verve Therapeutics, a company developing in-vivo gene editing to permanently lower cardiovascular risk, as a "landmark move" and a "paradigm shift". This strategy aims not to manage a risk factor for a lifetime but to eliminate it with a single intervention, representing the ultimate form of preventative medicine and a true longevity breakthrough.

The strong consensus on these three areas provides a clear and compelling roadmap for the future direction of the pharmaceutical industry. The companies that can establish leadership in one or more of these domains are poised to generate the most significant impact on human health and create the most value in the coming decades.

Comparative Analysis of Corporate Strategy Ratings

This qualitative assessment evaluates a company's strategic commitment to the field of longevity, looking beyond its pipeline to its partnerships, investments, and public statements. Here again, the models show strong agreement, rewarding companies that have made explicit and substantial investments in foundational aging science.

Corporate Strategy & Longevity Commitment Ratings (Top 5)

Note: Letter grades are from ChatGPT and Gemini; Grok provided a numerical rank.

The consistent high ratings for a select group of companies reveal a key trend: in the emerging field of longevity, a company's strategic narrative and its visible commitment to foundational science are becoming crucial metrics for evaluation.

The models universally reward explicit investment in geroscience. AbbVie's partnership with Calico is cited by all three reports as the primary justification for its top-tier strategy rating. The scale, duration, and stated aim of this collaboration—to understand and target the biology of aging—make it the industry's benchmark for strategic commitment. Similarly, Novartis is lauded for building an "ecosystem" of collaborations with cutting-edge longevity biotechs, and Novo Nordisk is recognized for its partnership with the high-profile cellular rejuvenation startup Altos Labs.

The Gemini report introduces a sophisticated distinction between "Healthspan Extension" (the traditional business of treating age-related diseases) and "Lifespan Science" (targeting aging itself). It argues that true strategic leadership lies in the latter. This framework explains why companies like Eli Lilly, while not having as many explicit geroscience partnerships, still receive a top strategy grade. Its acquisition of Verve's gene-editing platform is seen as a decisive strategic action that aligns perfectly with the principles of Lifespan Science—aiming for prevention and cure over chronic management.

This convergence indicates that the market is beginning to evaluate pharmaceutical companies not just on their current portfolio and late-stage pipeline, but on the boldness of their vision and their willingness to invest in the disruptive technologies that will define the future of medicine.

A Synthesized Outlook on Longevity Leadership in Pharma

By integrating the collective intelligence of the three LLM reports, a unified and coherent narrative of leadership in the pharmaceutical longevity sector emerges. This synthesis distills the points of consensus to construct a definitive view of the industry's past, present, and future, culminating in a final, integrated ratings framework.

The Historical Titans: Foundational Contributions (Pre-2010)

A clear consensus identifies Merck & Co. and Pfizer as the undisputed titans of the historical era. Their monumental impact on 20th-century health was driven by a powerful one-two punch that addressed the era's greatest threats to life. First, they led the charge against cardiovascular disease, the developed world's leading killer, with the commercialization of mass-market statins—Merck with the pioneering Mevacor and Zocor, and Pfizer with the all-time blockbuster Lipitor. These drugs prevented millions of heart attacks and strokes, generating colossal population-level QALY gains. Second, they made foundational contributions to controlling infectious disease. Merck's legacy is defined by its development of cornerstone vaccines like the MMR (measles, mumps, rubella), while Pfizer's history is anchored by its critical role in the mass production of penicillin, the antibiotic that is estimated to have extended average human lifespan by over two decades.

GlaxoSmithKline (GSK) forms a close third in this historical pantheon. Its impact was similarly driven by its status as a global vaccine powerhouse, contributing to immunization programs that have saved an estimated 154 million lives in the last 50 years, and by its pioneering development of the first antiretroviral therapies (like AZT), which transformed HIV/AIDS from a death sentence into a manageable chronic illness. Together, these three companies built the foundation of modern public health upon which all subsequent longevity gains have been built.

The Modern Vanguard: Immuno-Oncology and Metabolic Disease (2010-2025)

The modern era of longevity is defined by two parallel and equally transformative revolutions, with a new set of leaders emerging at the forefront of each.

The first revolution is in oncology. The development of immune checkpoint inhibitors by Merck (Keytruda) and Bristol Myers Squibb (Opdivo/Yervoy) has fundamentally redefined cancer care. For numerous malignancies, these therapies have achieved what was once unthinkable: inducing durable, long-term remissions in patients with metastatic disease. By turning many advanced cancers into chronic, manageable conditions, these companies have delivered profound gains in both lifespan and healthspan for hundreds of thousands of patients.

The second revolution, arguably with an even broader population scope, is in metabolic health. This has been spearheaded by Eli Lilly (Mounjaro/Zepbound) and Novo Nordisk (Ozempic/Wegovy). Their development of highly effective GLP-1 and dual-agonist therapies for obesity and Type 2 diabetes represents a return to the mass-market blockbuster model. These drugs are not just treating symptoms; they are targeting the foundational metabolic drivers—obesity and insulin resistance—that underpin a vast array of modern age-related diseases, from heart attacks and strokes to kidney failure and cancer. The sheer scale of this intervention positions this new class of therapies to have a long-term impact on public health that could one day rival that of statins.

The Future Architects: Geroscience and Curative Platforms (2025-2040)

Looking ahead, the consensus from the models indicates that future leadership will be seized by the companies that successfully pivot from a strategy of chronic treatment to one of prevention and cure. This requires mastering a new set of technologies and embracing a new scientific paradigm.

Eli Lilly is the consensus frontrunner in this future landscape. Its leadership is built on a three-pronged strategy that addresses the most significant opportunities in longevity. It is poised to extend its dominance in metabolic disease with a pipeline of next-generation oral and combination therapies; it has a major late-stage asset in the fight against Alzheimer's disease (donanemab); and, most significantly, it has made a decisive move into curative medicine with its acquisition of Verve Therapeutics and its in-vivo gene-editing platform for cardiovascular disease. This positions Lilly to lead in both treating and preventing the major diseases of aging.

Novo Nordisk is a strong second, leveraging its own GLP-1 dominance to build a comprehensive pipeline targeting the full spectrum of cardiometabolic diseases, while also investing in high-potential areas like cellular rejuvenation through its partnership with Altos Labs.

Beyond these two, AbbVie and Novartis are consistently recognized as high-potential future players due to their explicit and substantial investments in foundational aging biology. AbbVie's long-term, multi-billion-dollar alliance with Calico is the industry's most significant bet on geroscience. Novartis has strategically built an ecosystem of partnerships with cutting-edge biotechs to explore multiple aging pathways. These companies are not just developing better drugs; they are investing in the science that could one day allow medicine to treat aging itself, a high-risk, high-reward strategy that could unlock the next frontier of human healthspan.

The Analyst's Consensus: An Integrated Ratings Framework

This final framework synthesizes the varied outputs of the three LLMs into a single set of consensus ratings. This is derived by systematically comparing the models' assessments for each pillar and applying analytical judgment to resolve discrepancies, informed by the qualitative evidence presented in the reports. The goal is to provide a balanced and justified view that reflects the collective intelligence of the sources.

Consensus: Consensus Ratings for Pharmaceutical Longevity Impact

In conclusion, the three LLMs confirmed my original conjecture: Eli Lilly and Novo Nordisk have emerged as the clear current and future champions in the longevity-focused biopharma industry. Eli Lilly is slightly ahead, having publicly announced that longevity is now part of its corporate strategy at the 2024 ARDD conference. They also have Dr. Andrew Adams (see ARDD 2024 video), who—despite his relatively young age—has contributed to multiple drug approvals and openly discussed Lilly’s long-term commitment to the longevity space.

Lilly has several approved therapeutics with strong longevity potential, including GLP-1/GIP dual agonists, a robust anti-Alzheimer’s portfolio, and—let’s not forget—Cialis (tadalafil), which may contribute to healthy aging, particularly when used in a low-dose daily 5mg regimen. I envision a world where, after age 60, individuals routinely receive anti-amyloid and anti-tau treatments every few years, reducing the risk of dementia. Based on the favorable safety profile of Lilly’s anti-amyloid and anti-tau drugs, I’d personally consider undergoing a treatment course today. My wager is simple: if the amyloid or tau hypotheses are correct, I reduce my risk of Alzheimer’s; if not, I’ve merely invested in R&D that could benefit others.

Moreover, Lilly’s drug portfolio includes many agents that rank highly in Nir Barzilai’s geroprotector scoring framework. For example, their SGLT2 inhibitor empagliflozin (Jardiance) improves glycemic control while significantly lowering cardiovascular and renal risks—outcomes associated with reduced mortality in type 2 diabetes. Lilly’s GLP-1 receptor agonist dulaglutide and the dual GIP/GLP-1 agonist tirzepatide (marketed as Mounjaro for diabetes and recently approved as Zepbound for obesity) offer substantial weight loss and metabolic improvements. Tirzepatide, in particular, reduced the incidence of heart failure by ~38% in clinical trials and achieved greater weight loss than semaglutide.

The company is also advancing next-generation incretin mimetics: the oral GLP-1 agonist orforglipron, and the triple agonist retatrutide, which induced ~24% weight loss in Phase 2 and is now in Phase 3 trials targeting obesity-related complications like sleep apnea and osteoarthritis.

Beyond metabolic disease, Lilly’s monoclonal antibody donanemab targets β-amyloid plaques in Alzheimer’s disease, slowing cognitive decline by ~35%. They are also exploring muscle-preserving agents such as the activin receptor inhibitor bimagrumab, which enhances lean mass during weight loss and may counteract sarcopenia and frailty. In parallel, anti-fibrotic programs like their WISP1 antibody target chronic fibrotic diseases of aging, including idiopathic pulmonary fibrosis (IPF).

Additionally, Lilly’s pipeline includes a first-in-class in vivo PCSK9 gene-editing therapy for lifelong cholesterol reduction and siRNA-based drugs that address metabolic aging contributors like hepatic fat and dyslipidemia. These multi-pronged efforts—spanning metabolic, cardiovascular, neurodegenerative, musculoskeletal, and fibrotic pathways—underscore Lilly’s strategic depth and commitment to developing the next generation of longevity therapeutics.

In closing, several major pharmaceutical companies are now deeply engaged in aging research, both as a scientific frontier and as a platform for therapeutic innovation. To explore their latest contributions and network with the key players, attend the 12th Aging Research and Drug Discovery (ARDD) meeting in Copenhagen (www.AgingPharma.org). It’s an unparalleled venue for discovering the future of aging science—and perhaps your future collaborators.

Alex - you are spot on and Thanks for sharing your insights - it will probably take a generational change for companies to evolve to a new way of thinking - being at both Pharma & Biotech, over many decades. However, the real opportunity is - How can we leverage AI to bring about that mindshift change in the next 10 years. Lets partner and initiate the conversations to effect radical transformation. Call me!

interesting read; thanks Alex!